01 September | 2 MIN READ

Sustainable Manufacturing: A Strategic Imperative for Southeast Asia

Manufacturers worldwide are facing a paradigm shift – sustainability is no longer optional but a competitive necessity. Global policies like the EU’s Green Deal (55% emissions cut by 2030, net-zero by 2050) and the new Carbon Border Adjustment Mechanism (CBAM) effectively tax carbon-intensive imports. Simply put, “you either strive forward or fall behind”. Citing ATS Global, “sustainable manufacturing is no longer a buzzword or a choice, but a necessary undertaking to reduce costs, look after our environment and remain relevant”. Products made without embedded green processes may face tariffs or be shut out of eco-conscious markets.

Figure: Sustainable practices are now key to global competitiveness

Global Policy Changes and Market Demands

- Carbon Tariffs and Standards: The EU has introduced CBAM – a border levy on imports of steel, cement, aluminum and other high-carbon goods. Importers must declare embedded emissions and buy carbon certificates, leveling the playing field for EU producers. Similar policies are in the pipeline in the US, UK and Canada. In practice, this means any factory exporting to Europe must either decarbonize or pay hefty fees. As one analysis notes, CBAM “promotes decarbonization of international trade and makes domestic products more competitive”. ASEAN countries (Indonesia, Malaysia, Vietnam, etc.) are already critical of these rules, warning that without green processes they will lose competitiveness.

- Green Regulations in ASEAN: Southeast Asian governments are rapidly tightening their own rules. For example, Singapore will mandate Scope 1 and 2 emissions reporting for companies by 2025; Malaysia and Thailand are adopting new global sustainability disclosure standards. Seven ASEAN countries have announced net-zero targets under the Paris Agreement, and the region’s sustainable bond market has soared (2017–2023: USD3.4B to USD72.7B, ~68% CAGR). This reflects rising investor and consumer demand: by 2050, over 35% of ASEAN GDP could be exposed to climate risks. In short, green policies are coming – now is the time to prepare.

- Customer & Supply-Chain Pressure: Buyers and supply chains increasingly demand eco-friendly credentials. ATS Global notes that “green credentials are now a key influencer when making purchasing decisions”. Companies with transparent, sustainable supply chains earn preferred status, while others risk losing deals. Digital supply chains can even share sustainability information end-to-end, rewarding those who can prove low-carbon processes. In today’s market, unsustainable products simply won’t competeable.

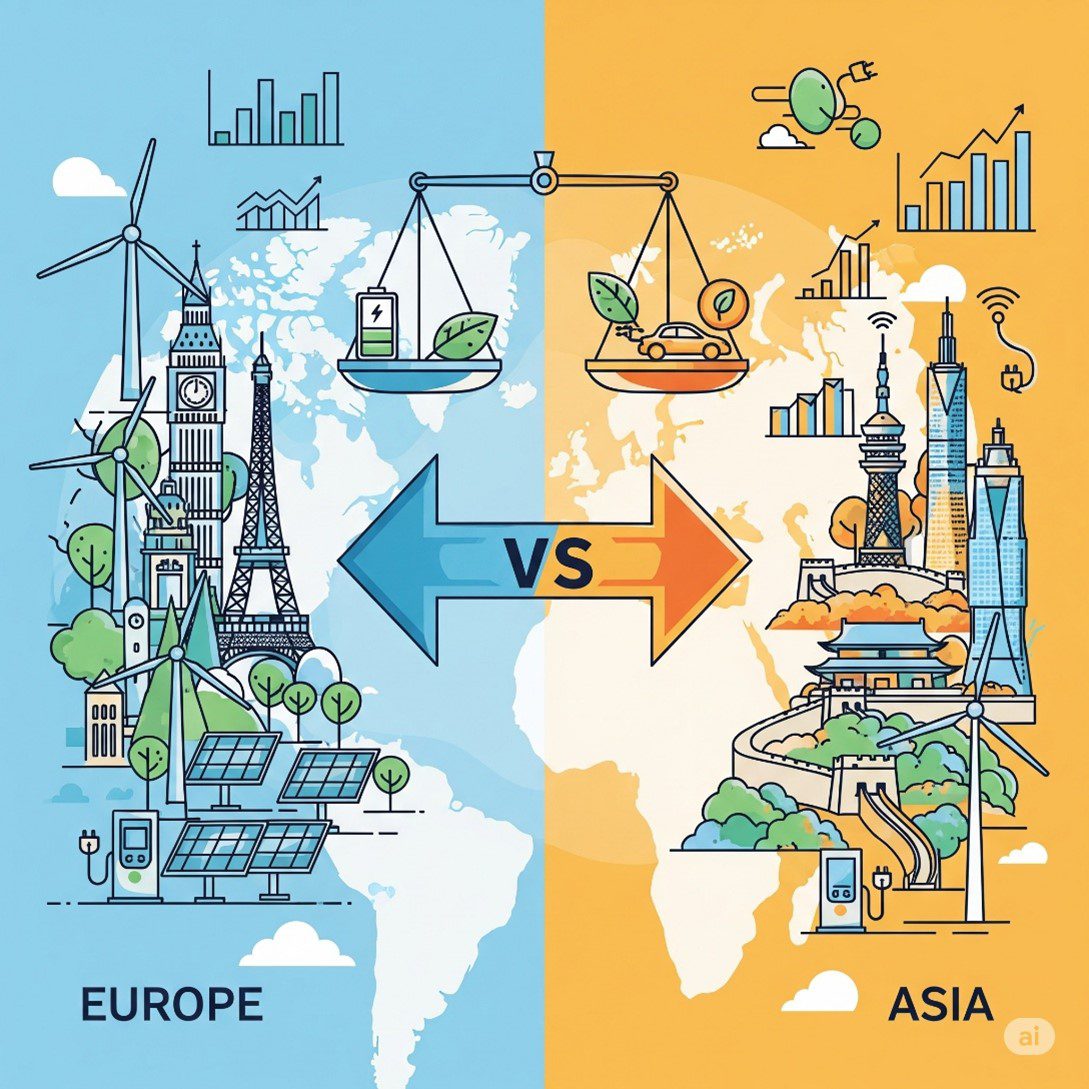

Europe vs Asia: Competitiveness in the Green Economy

Figure: Europe vs. Asia sustainable manufacturing competitiveness – Brussels Effect regulations vs. Asia’s rapid green energy growth and cost advantages.

Europe has long set the pace on sustainability standards – the so-called “Brussels Effect” lets its rules reverberate globally. However, Asia is rapidly catching up. According to the World Economic Forum, Asia accounted for 60% of global economic growth in 2024, far outpacing Europe. China, for example, has already electrified a larger share of its economy than the entire EU (surpassing the EU’s 30% 2030 target). Southeast Asia itself is investing heavily in renewable manufacturing: solar panel and battery production is expanding, and major projects in wind, hydro and geothermal are underway. Notably, ASEAN can produce solar panels at only ~4% higher cost than China, and the cost of investing in green energy is ~50% lower than in the EU. In other words, SEA has a strong base to become a “green industry power”.

Yet despite Asia’s scale, European manufacturers often enjoy an R&D and regulatory edge. Policymakers in Brussels warn that if Europe innovates, cooperation yields mutual growth; but if it lags, Asia and other regions will benefit. ASEAN nations have voiced concern that EU measures like the Deforestation Regulation (EUDR) and CBAM could be unfairly burdensome. This tug-of-war means Southeast Asian manufacturers must accelerate their green transition now – or risk ceding markets and investment to greener rivals.

Why Act Now: Risks of Delay

For C-level leaders and plant managers in SEA, the stakes are clear:

- Market Access: Upcoming trade rules and customer preferences favor green products. The EU’s deforestation and carbon rules (effective 2025–2026) have drawn sharp objections from SEA governments for good reason[6][7]. Without demonstrable sustainability, major export markets could close their doors.

- Cost & Efficiency Benefits: Sustainable practices often reduce costs. ATS Global highlights that cutting waste (including scrap, rework and under-utilized assets) yields both environmental and financial gains[22]. Likewise, a study by HanAra Software notes that real-time energy monitoring enables firms to “reduce costs, emissions, and unknown variability”[23]. Investing in energy-efficient equipment and processes pays off via lower utility bills and fewer resources per unit of output.

- Innovation & Investment: Early movers will set industry benchmarks. In the UK, manufacturers adopting renewables and low-carbon products “are poised to capture a larger share of markets demanding sustainable goods”[24]. New green sectors (renewable energy jobs, clean-tech manufacturing, etc.) will grow, creating opportunities for those who build skills now[25].

- Supply Chain Stability: Climate change itself poses risks: floods, heatwaves and resource shortages threaten operations. ASEAN economies face higher exposure (35%+ of GDP by 2050) if climate impacts worsen[10]. Sustainable manufacturing (e.g. circular economy, energy resilience) is not just about complying; it’s about future-proofing the business.

Strategies for Sustainable Manufacturing

To remain competitive, Southeast Asian manufacturers should prioritize these steps:

- Measure and Monitor: “What you need tomorrow depends on what you are doing today.” Begin with accurate data on your current processes and environmental impact[26]. Implement energy and production monitoring systems (e.g. IoT sensors connected to MES) to track power use, material flow and emissions in real time. As HanAra Software advises, robust energy management (via data historians and dashboards) lets companies pinpoint inefficiencies[23][27]. With visibility, managers can set reduction targets and quantify progress.

- Integrate IT/OT Systems: Converge IT (ERP) and OT (MES/MOM) platforms so that sustainability data flows across the enterprise. When MES reports actual energy use and yields, ERP can correlate that with costs and sales. For example, advanced MES–ERP integration “tracks energy use, emissions, scrap & rework” and turns them into actionable sustainability metrics[28]. Real-time MES data fed into ERP allows dynamic scheduling: if machines heat up or waste spikes, the system can adjust jobs or trigger maintenance. In short, digitally connecting the shop floor and business systems is critical to sustain progress[28][29].

- Optimize Energy Use: Invest in renewable energy (solar, biogas, etc.) and efficiency upgrades. Conduct energy audits to find leaks or idle loads. A modern Energy Management System can even use AI to forecast and optimize consumption. As HanAra’s example shows, linking energy monitoring with daily operations helps focus efforts on the biggest savings[27]. ATS Global can guide the deployment of such systems, integrating clean-energy sources and automated controls to trim the carbon footprint.

- Reduce Waste and Scrap: Lean manufacturing and sustainability go hand-in-hand. Identify non-value-add steps that burn energy or materials. ATS notes that waste often hides where efficiency efforts neglect – e.g. unused equipment or rework loops[22]. Use MES analytics to find bottlenecks or quality issues, then eliminate them. Every kilogram of scrap avoided not only cuts material cost, but also the embedded energy cost of re-melting or reprocessing.

- Engage the Whole Organization: Sustainability must be a strategic priority. ATS suggests creating an “Eco Fund” where savings from efficiency are reinvested into further green projects[30]. Train staff on energy-conscious practices and empower teams to suggest improvements. Ensure suppliers meet your criteria – digital tools can help verify that inbound materials comply with deforestation or emissions regulations[12]. This cultural shift solidifies sustainability as core business value, not a one-off initiative.

Figure: Solar and wind investments are accelerating worldwide. ASEAN countries produce solar panels and wind turbines at competitive costs[18][17].

ATS Global Solutions: Driving Sustainable Transformation

ATS Global specializes in the IT/OT integration and data analytics that make these strategies work. For ASEAN manufacturing leaders, we offer:

- Energy Management & Monitoring Systems: We implement systems that collect real-time energy and production data across machines. Using platforms like data historians and SCADA, we centralize this information for analysis. This enables continuous monitoring of metrics (energy per unit, CO₂ per batch, etc.) so teams can spot anomalies and plan improvements. As HanAra emphasizes, such data-driven energy management directly cuts costs and emissions[23][27].

- MES/MOM Integration with ERP: Our expertise in IT-OT convergence means MES/MOM solutions are tightly linked to ERP. This creates a unified digital thread from shop floor to C-suite. As one industry guide notes, MES-ERP integration unlocks critical capabilities – optimizing resource use, agility, quality and sustainability[31][28]. In practice, ATS can configure systems so that every kilowatt-hour and kilogram of material is tracked and reported through your business intelligence. This transparency is key to winning customers and complying with regulations.

- Process Optimization and AI: We help manufacturers apply AI and analytics on their operations. Predictive models can forecast energy peaks or maintenance needs, while digital twins simulate greener scenarios without production risk. ATS consultants work with your teams to map value streams, identify waste hotspots, and deploy Industry 4.0 technologies. The result is a leaner production line – using less energy and yielding less scrap – without sacrificing throughput.

- Sustainability Roadmapping: Beyond technology, ATS provides advisory services. We collaborate with executives to define clear Net-Zero roadmaps, including cultural change management. Our approach mirrors ATS’s own advice: set continuous improvement cycles (an “Eco Fund”), measure every gain, and keep raising the bar[30][3]. We help quantify ROI on green investments, proving that sustainable practices enhance profitability as well as reputation.

Looking Ahead: The Cost of Inaction

The competitive gap between “green” and “gray” manufacturers will only widen. If Southeast Asian companies delay their sustainability journey, they risk:

- Loss of market share as global buyers favor certified low-carbon suppliers[12][1].

- Higher trade barriers and tariffs on exports to major markets[1][6].

- Missed efficiency gains: Greener operations often mean leaner costs. According to ATS, becoming “more eco-conscious within facilities and processes will reduce costs”[11].

- Investor and talent flight: ESG-minded investors and skilled workers prefer companies with a clear sustainability vision.

In contrast, the early adopters will thrive. ASEAN nations are poised to be global green-tech suppliers[18], and manufacturers who lead this transformation will capture new customers and partnerships. Europe and other regions are increasingly rewarding sustainable innovation (through incentives, R&D grants, preferential procurement, etc.), and Southeast Asian firms can join those benefits by acting now.

In summary: The writing is on the wall. The world’s policies and markets are pivoting to sustainability[11][1]. Southeast Asian manufacturers must rethink processes, measure everything, and invest in green technology to compete internationally. ATS Global stands ready to support this transformation with energy management systems, integrated MES/ERP solutions, and a proven roadmap to sustainable manufacturing[28][32]. As one ATS source puts it, companies “who proactively adopt eco-friendly practices… are poised to capture a larger share of markets demanding sustainable goods”[33]. Those who ignore this shift, risk being left behind – on efficiency, on compliance, and ultimately, on profit.

________________________________________

This part is references.[1] [4] [5] Implications of the EU’s Carbon Border Adjustment | FTI

https://www.fticonsulting.com/insights/articles/implications-eus-carbon-border-adjustment-mechanism-asia

[2] [3] [11] [12] [22] [26] [30] Why care about Sustainability? | ATS Global

https://www.ats-global.com/resources/blogs/why-care-about-sustainability/

[6] [7] [13] [21] Reassessing the European Green Deal in Southeast Asia: Europe should embrace local contexts – CEIAS

https://ceias.eu/reassessing-the-european-green-deal-in-southeast-asia/

[8] [9] [10] ASEAN’s sustainability policy overhaul calls for updated strategies from Japanese firms but also offers growth opportunities | EY Japan

https://www.ey.com/en_jp/insights/sustainability/asean-sustainability

[14] [15] [20] Europe’s competitiveness agenda: what leaders are saying | World Economic Forum

https://www.weforum.org/stories/2025/07/europes-competitiveness-agenda-everything-everywhere/

[16] [17] [18] [19] BIPR | South-East Asia Will Become a Green Industry Power

https://bipr.jhu.edu/BlogArticles/29-South-East-Asia-Will-Become-a-Green-Industry-Power.cfm

[23] [27] Boosting Factory Energy Management | HanAra

https://www.hanarasoft.com/energy-management/

[24] [25] [32] [33] Navigating the Path to Net-Zero Manufacturing

https://www.ats-global.com/resources/blogs/navigating-the-path-to-net-zero-manufacturing/

[28] [29] Cost-Effective Solutions: Integrate MES with ERP Systems in Manufacturing – Dassault Systèmes blog

https://blog.3ds.com/brands/delmia/cost-effective-solutions-integrate-mes-with-erp-systems-in-manufacturing/

[31] How ERP and MES Work Together to Optimize Manufacturing Efficiency

https://parsec-corp.com/infographics/erp-mes-integration-efficiency/